The economy is fine, so we’re told. There is no recession, so we’re told. The Federal Reserve has everything under control, so we’re told. Meanwhile, 3.8 million Americans say they could face eviction in the next two months.

It doesn’t sound like everything is fine.

The median rent in the US eclipsed $2,000 per month in June for the first time ever. It’s another symptom of rampant inflation burning through the US economy.

While the CPI cooled slightly in July, shelter costs rose another 0.5% month-on-month. On a yearly basis, shelter costs have spiked by 5.7%, according to government numbers. And the CPI drastically understates the cost of housing. Actual rents have increased more than 15% in the last 12 months, according to data compiled by Zillow.

With rents skyrocketing, households representing 8.5 million people are behind on their rent, according to the Census Bureau. Of those, 3.8 million say they are somewhat or very likely to be evicted within the next two months.

According to Yahoo Finance, “The combination of soaring inflation, the end of most eviction moratoriums and rental assistance payments and an extremely low vacancy rate has pushed rents up — and many renters out.”

Nearly half of all renters experienced rent hikes in the past 12 months, according to Census Bureau data. Eleven percent have seen rent increases of over $250 per month.

To make ends meet, people are turning to credit cards and loans, raiding savings, selling assets, and dipping into retirement funds. According to the Census Bureau, 57% of renters said they were forced to resort to one of these desperate measures to keep up with their rent.

This dovetails with the skyrocketing levels of household debt. Americans added another $40.1 billion to their debt load in June alone. That represented a 10.5% year-on-year increase. Credit card balances increased by $46 billion in the second quarter of this year. Over the last year, credit card debt has exploded by 13%, the biggest increase in over 20 years.

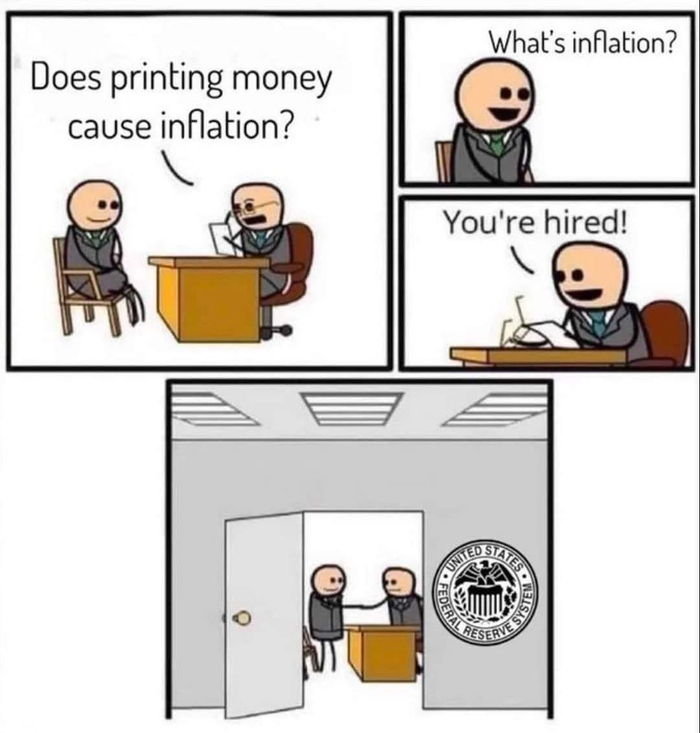

According to Yahoo Finance, the Fed’s efforts to stem inflation are adding to the pain. With mortgage rates rising, renters who were hoping to buy homes have been priced out of the market.

You must be logged in to post a comment.