The White House fears that an impending Congressional Budget Office analysis will say Democrats’ spending bill would increase federal deficits. The dispute seems unsurprising, given the myriad budgetary gimmicks in the bill—but not for the reasons one might expect.

Ignore for a moment the fact that the bill contains ten years of tax increases to pay for a few years’ of spending that Democrats later hope to extend, meaning that independent budget analysts have pegged the bill’s true ten-year cost not at $1.75 trillion but nearer to $5 trillion. Ignore too the fact that front-loading the bill’s spending means it will almost certainly increase federal deficits in the short-term, exacerbating inflation at a time price increases are already at 30-year highs.

Instead, the proximate dispute with CBO concerns whether an increase in tax enforcement will yield as much revenue as Treasury claims. On that front, one of the biggest arguments against the Biden administration’s position comes via Joe Biden himself.

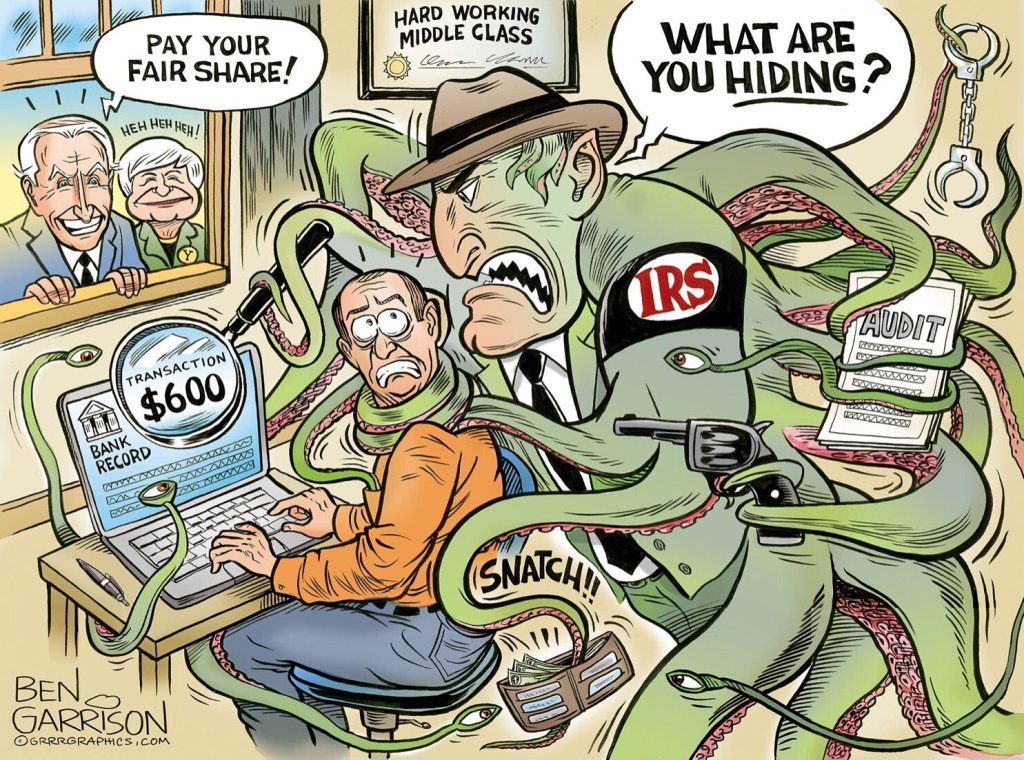

Dueling Tax Estimates

The New York Times reported Monday that “the White House has begun bracing lawmakers for a disappointing estimate” from CBO, and is “urging lawmakers to disregard the budget office assessment, saying it is being overly conservative in its calculations.” While administration officials say additional tax enforcement will generate $400 billion in new revenue, CBO Director Philip Swagel on Monday said he stood by the agency’s September estimate that enhanced enforcement authority will net roughly $120 billion.

The difference between the lower and higher revenue figures could determine whether the bill gets scored as a budget-saver or budget-buster. Treasury has therefore come out swinging at CBO, with Assistant Treasury Secretary Ben Harris calling the office’s methodology “patently absurd” in an interview with the Times.

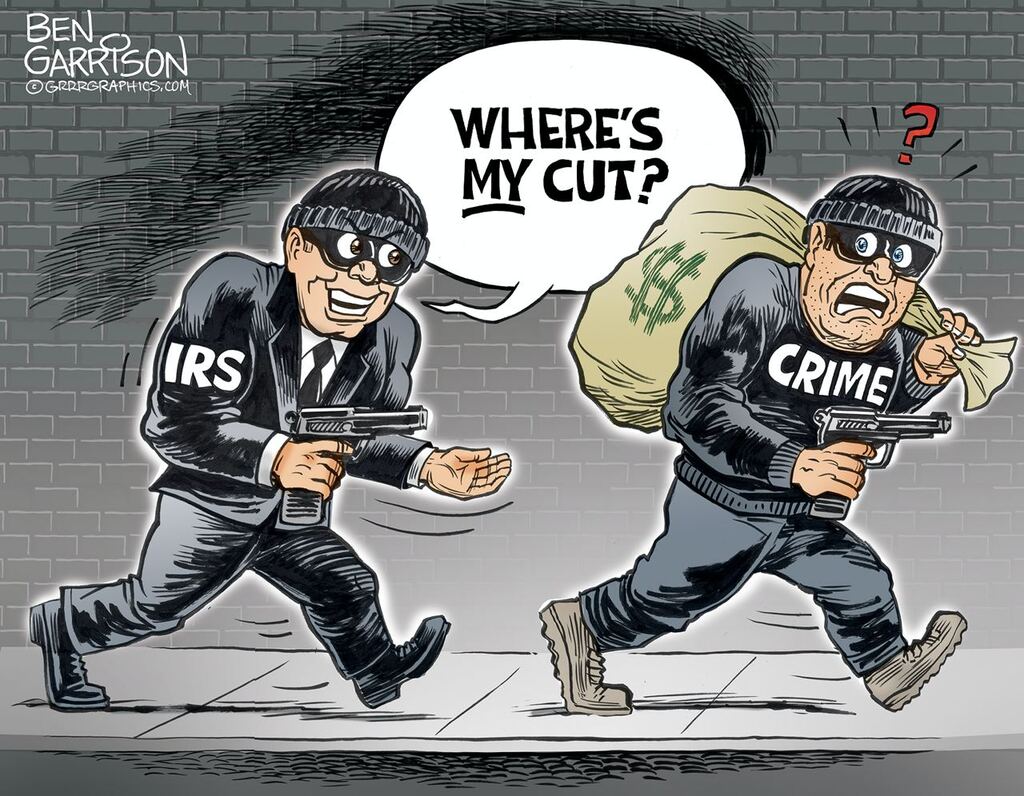

Whither IRS Enforcement?

But given his own boss’ conduct, Mr. Harris doth protest too much on tax enforcement. After leaving the vice presidency in early 2017, Joe Biden and his wife Jill created two S-corporations, and characterized most of their book and speech earnings as profits from those corporations rather than taxable wages.

These maneuvers allowed the Bidens to dodge nearly $517,000 in payroll taxes. The Tax Policy Center called the Bidens’ actions “pretty aggressive.” And a recent Congressional Research Service report outlined several instances in which federal courts agreed with the IRS in requiring S-corporations to pay back taxes—all of which arguably applied to the Bidens.

Yet despite the Bidens’ public release of their returns, and coverage of the irregularities surrounding them, no news has yet emerged of an IRS audit. Why?

Keep reading

You must be logged in to post a comment.