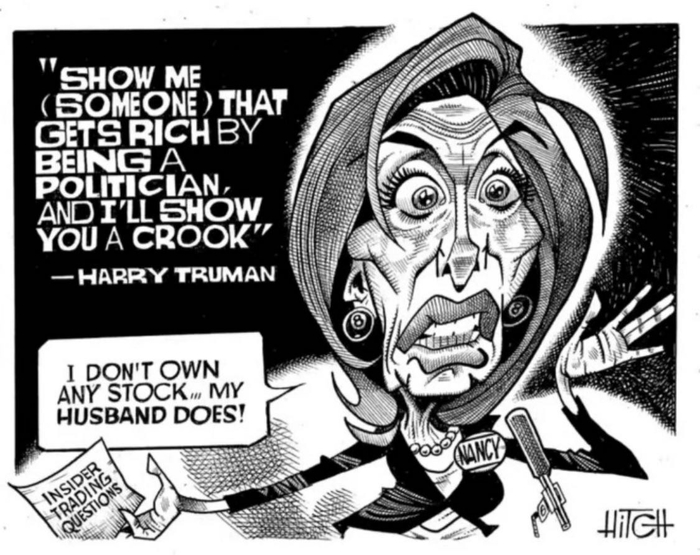

Plausible deniability…

House Speaker Nancy Pelosi’s husband Paul bought up to $5 million in stock of a computer chip company ahead of a vote on a bill next week that would hand billions in subsidies to boost chip manufacturing, a financial disclosure shows.

Paul Pelosi purchased 20,000 shares of Nvidia, one of the world’s largest semiconductor companies, on June 17, according to the speaker’s disclosure report released Thursday. Now, senators will convene as early as Tuesday to vote on a bipartisan competition bill, which allocates $52 billion to boost domestic semiconductor manufacturing and gives tax credits for production, Reuters reported Thursday.

“It certainly raises the specter that Paul Pelosi could have access to some insider legislative information,” Craig Holman, a government affairs lobbyist for the left-wing think tank Public Citizen, told the Daily Caller News Foundation. “This is the reason why there is a stock trading app that exclusively monitors Paul’s trading activity and then its followers do likewise.”

As members of Congress debate whether lawmakers and their spouses should play the stock market, House Speaker Nancy Pelosi’s husband, Paul Pelosi, a venture capitalist, continues to regularly buy and sell stocks and stock options.

Pelosi has access to confidential intelligence and the power to affect — with words or actions — the fortunes of companies in which her husband invests and trades.

When asked in December 2021 whether members of Congress should even be allowed to trade stocks, Pelosi answered in the affirmative.

“We are a free-market economy. They should be able to participate in that,” she said.

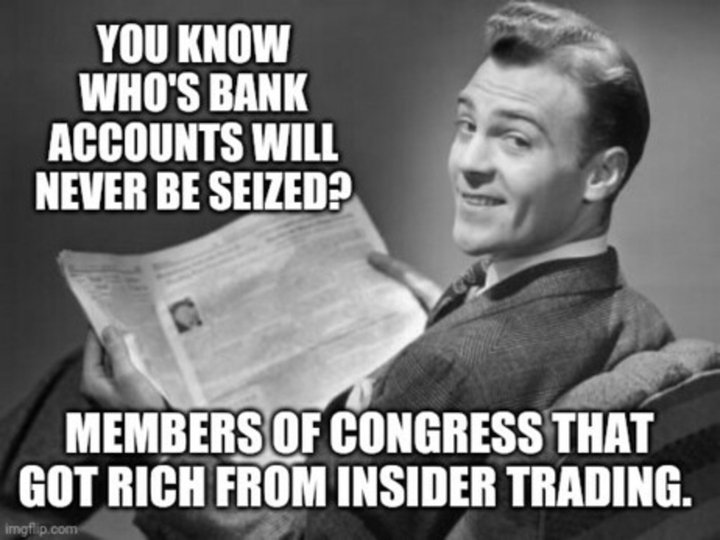

This led some of her colleagues, on both the left and the right, to sharply criticize her — and draft legislation to restrict members of Congress and their spouses from trading stocks.

“Year after year, politicians somehow manage to outperform the market, buying and selling millions in stocks of companies they’re supposed to be regulating,” Republican Sen. Josh Hawley said. “Wall Street and Big Tech work hand-in-hand with elected officials to enrich each other at the expense of the country. Here’s something we can do: ban all members of Congress from trading stocks and force those who do to pay their proceeds back to the American people. It’s time to stop turning a blind eye to Washington profiteering.”

Sen. Jon Ossoff, a Democrat, introduced a similar bill alongside Sen. Mark Kelly with the intent to ban members of Congress and their families from trading stocks.

“Members of Congress should not be playing the stock market while we make federal policy and have extraordinary access to confidential information,” Ossoff said.

Pelosi has since softened her stance, but the fate of a congressional stock-trade ban remains unclear.

A previous analysis from Insider estimated that the Pelosis are worth at least $46,123,051, making Nancy Pelosi one of the 25 richest members of Congress. The vast majority of the couple’s wealth is derived from stocks, options, and investments made by Paul Pelosi.

House Speaker Nancy Pelosi’s husband purchased 2,500 shares of Tesla stock amid Democrats’ push for increased green energy spending.

Paul Pelosi, the Democratic House leader’s millionaire husband, purchased the tranche of Tesla stock on Thursday, when the company’s share price reached about $872 per share by the end of day, according to congressional filings published Monday. Pelosi bought the shares, worth roughly $2.18 million at the time, at a strike price of $500 per share.

Since Paul Pelosi’s purchase, Tesla’s share price increased nearly 19% to over $1,036 a share, making his tranche worth nearly $2.6 million.

A government watchdog group asked the Office of Congressional Ethics last week to investigate Assistant Speaker of the House Katherine Clark, D-Mass., for apparently failing to timely disclose up to $285,000 in financial transactions — making the potential successor to House Speaker Nancy Pelosi, D-Calif., the latest among numerous House and Senate members to face ethics complaints about allegedly violating the STOCK Act.

The Stop Trading on Congressional Knowledge Act, better known as the STOCK Act, has gained renewed attention during the COVID-19 pandemic when some lawmakers were suspected of using information from government roles to profit.

Broadly, the law prohibits members of Congress, congressional staffers and certain members of the executive branch and federal judiciary from engaging in insider trading based on information they learn through their government jobs. One provision of the law requires members of Congress to make a “full and complete” statement of their assets and their spouse’s assets, debts and income, as well as periodic reports of financial transactions that exceed $1,000 within 30 to 45 days of the transaction.

You must be logged in to post a comment.