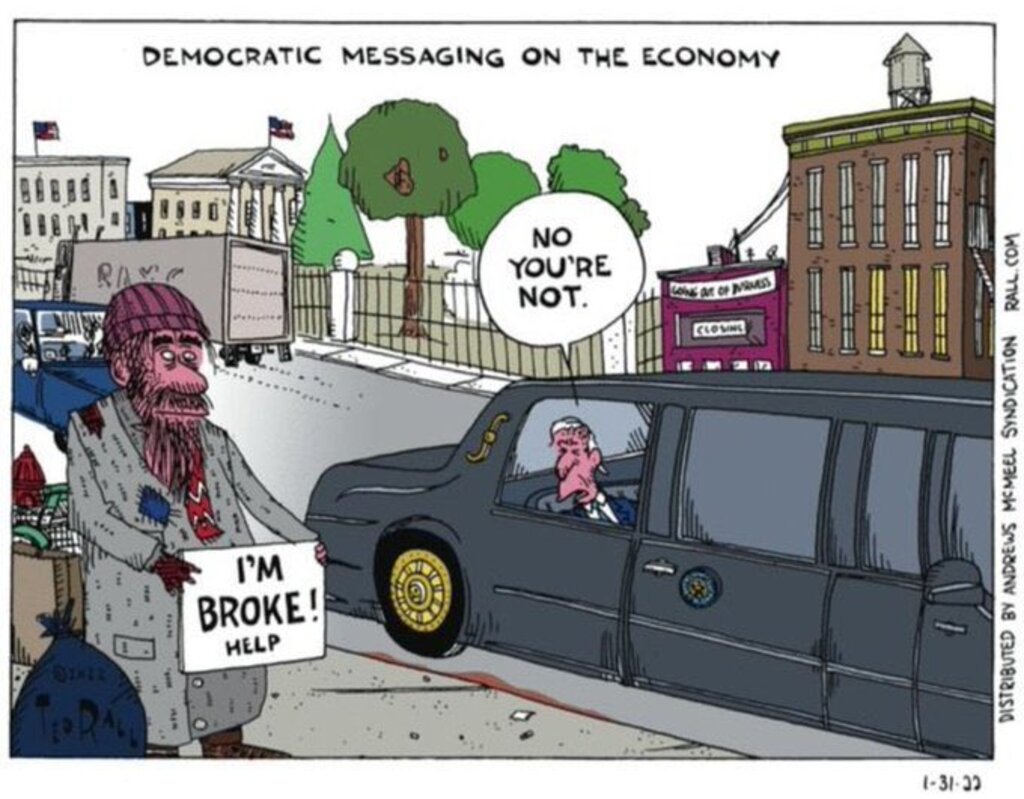

Whatever you say…

CNN faced intense backlash online Friday after publishing a report that suggested Americans should view a slight dip in gas prices as a “$100-a-month raise” or a “$100-a-month tax cut.”

The national average price of gasoline was $2.38 per gallon when President Joe Biden assumed office, according to the Energy Information Administration, and increased to $3.53 per gallon by the start of the Russian invasion of Ukraine, The Daily Wire reported. Prices surpassed $5.00 per gallon in early June before subsiding to $3.92 per gallon as of Friday, according to AAA.

CNN Business senior writer Chris Isidore lauded the decline in gas prices without mentioning that costs remain highly elevated from the level seen less than two years ago.

“Next time you stop at a gas station, think of it as a $100-a-month tax cut. Or a maybe $100-a-month raise,” Isidore wrote. “The steady drop in gas prices over the last few months has turned into an unexpected form of economic stimulus, coming at a time when the Federal Reserve is trying to cool the economy and battle rising prices with higher interest rates.”

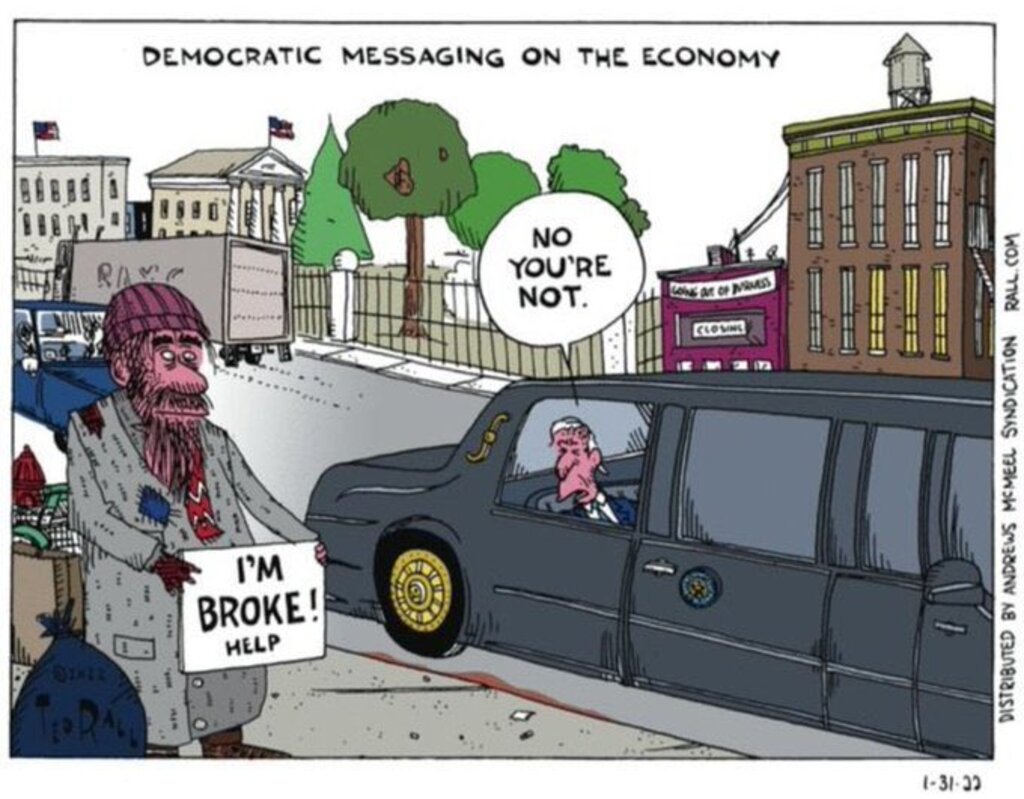

Critics absolutely roasted Energy Secretary Jennifer Granholm after she suggested that lower to middle class Americans could fight the rising cost of living by investing thousands in solar panels and other green energy initiatives.

Granholm made an appearance on “Fox News Sunday” to explain how the recently-passed Inflation Reduction Act — which has since been touted as a tax, energy, and health care bill — would impact everyday Americans who are struggling with record-high inflation, food, gasoline, and energy costs.

“If you are low income, you can get your home entirely weatherized through the expansion from the bipartisan infrastructure laws, a significant expansion — you don’t have to pay for anything,” she said, adding, “”If you want heat pumps, insulation, new windows, that is covered,” she said. “If you are moderate income, today you can get 30% off the price of solar panels. Those solar panels can be financed, so you don’t have to have the big outlay at the front … If you don’t qualify for the weatherization program, you will be able to, starting next year, get rebates on the appliances and equipment that will help you reduce your monthly energy bill by up to 30%. That is all about reducing costs for people.”

But as critics quickly pointed out, people who were struggling to feed their kids or wondering how they’d afford the gas to get to work were not just waiting on a 30%-off sale to make the jump to solar — they were just doing what they could to get by.

“GOP just needs to run ad after ad of Granholm telling the poors to buy solar panels and electric cars to save money,” Erick Ericksen tweeted.

The chance of “widespread civil unrest” occurring in the UK as a result of people being unable to afford to pay their bills due to the cost of living crisis is “inevitable,” according to one campaigner.

With energy prices set to soar even higher in October as a result of the sanctions on Russia, many Brits have resolved to refuse to pay their bills as part of a growing backlash some are comparing to the poll tax riots.

London was hit with violent riots back in 1990 in response to the government’s efforts to introduce the poll tax, and the new levy was eventually scrapped after a coalition of interest groups amongst both the working class and the middle class combined to defeat it.

A similar movement under the umbrella of the Don’t Pay organization is now urging people to cancel their direct debits in October if energy prices continue to rise.

Average energy bills in the UK for dual fuel are expected to rise to £3,615 by January 2023, an increase of 283 per cent on March levels.

“Millions of us won’t be able to afford food and bills this winter,” asserts the Don’t Pay manifesto. “We cannot afford to let that happen. We demand a reduction of bills to an affordable level. We will cancel our direct debits from October 1st if we are ignored.”

San Francisco Fed President Mary Daly, who makes $422,900 per year – and scrambled out of dozens of investments last year shortly before the Fed finalized strict new limits on policymakers’ portfolios – just had her ‘Nancy Pelosi Ice Cream” moment, dropping a sidewalk-spattering turd from her ivory tower on the average struggling American.

During an interview with Reuters broadcast live on Twitter spaces, Daly said: “I don’t feel the pain of inflation anymore. I see prices rising but I have enough… I sometimes balk at the price of things, but I don’t find myself in a space where I have to make tradeoffs because I have enough, and many Americans have enough.”

You must be logged in to post a comment.