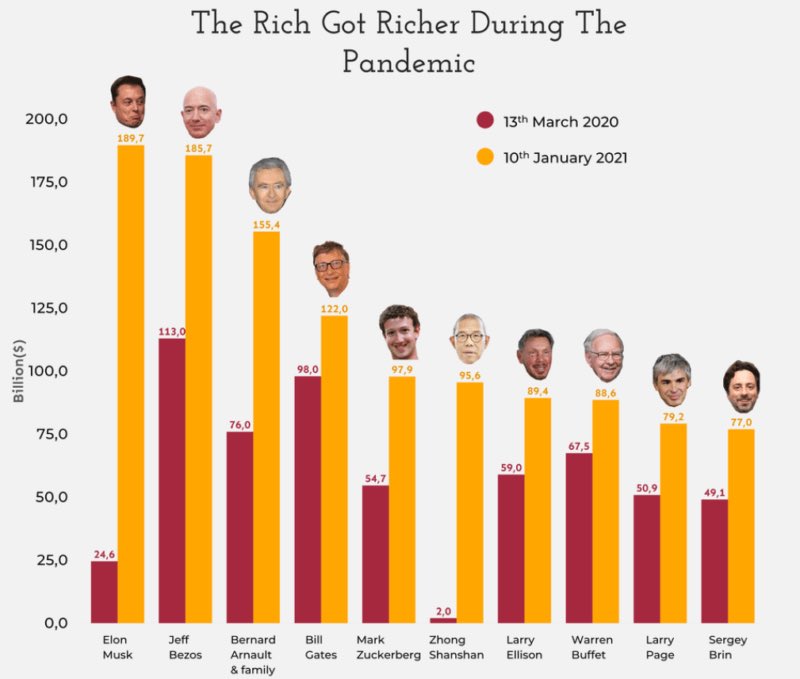

Recent history is punctuated with a lot of not-so-great economic “greats” from the Great Depression to the Great Recession. Now we have a new one: When historians look back on the decisions made beginning in March 2020 and still going strong, this period will be remembered as the “Great Consolidation”—the acceleration of a historic wealth transfer and power concentration out of the hands of the middle class and into those with political power and connections.

The “connected” form a powerful bloc comprised of big government, big business and big special interests. And though their monikers label them “big,” they are comprised of relatively small elites. And they are seeking to use their power to benefit themselves at your expense.

Prior to COVID, more than 30 million small businesses accounted for about half the GDP and jobs in America; the other half of the economy was concentrated in 20,000 big companies. So you might have expected that small businesses would have had an equal amount of negotiating power when the pandemic hit as big companies. You would be wrong.

Big companies have more lobbying dollars and more connections, and thus more ability to play the political game. Their big pockets are balanced with a small enough scope to make them a government ally, compared to the highly decentralized small business landscape.

As a result, big firms were deemed “essential” and allowed to stay open during the pandemic, while small businesses were subjected to punishing lockdown orders and forced to close, in part or completely. Many of the examples were doubly infuriating given the absurd hypocrisies they presented. For example, big box pet retailers like PetSmart that groomed pet hair and nails were deemed essential—while salons owned by small business owners that served humans were not. The LA-area Pineapple Hill Saloon and Grill was forced to close their outdoor dining—while a movie production not only operated but hosted a catering tent serving food to crew in the same parking lot that the restaurant had been forced to abandon. Weed dispensaries, illegal just a handful of years ago in many jurisdictions, were suddenly deemed essential.

You must be logged in to post a comment.