Speaker of the House Nancy Pelosi doesn’t want Congress banned from trading stocks because she profits big from her and her husband’s investments on a regular basis.

In a press conference on Monday, the Democrat said that representatives and senators should do their best to comply with the reporting standards required by the Stop Trading on Congressional Knowledge Act, signed into law in 2012, but rejected the suggestion that legislators and their spouses should be barred from trading.

“We are a free market economy that should be able to participate in that,” Pelosi said.

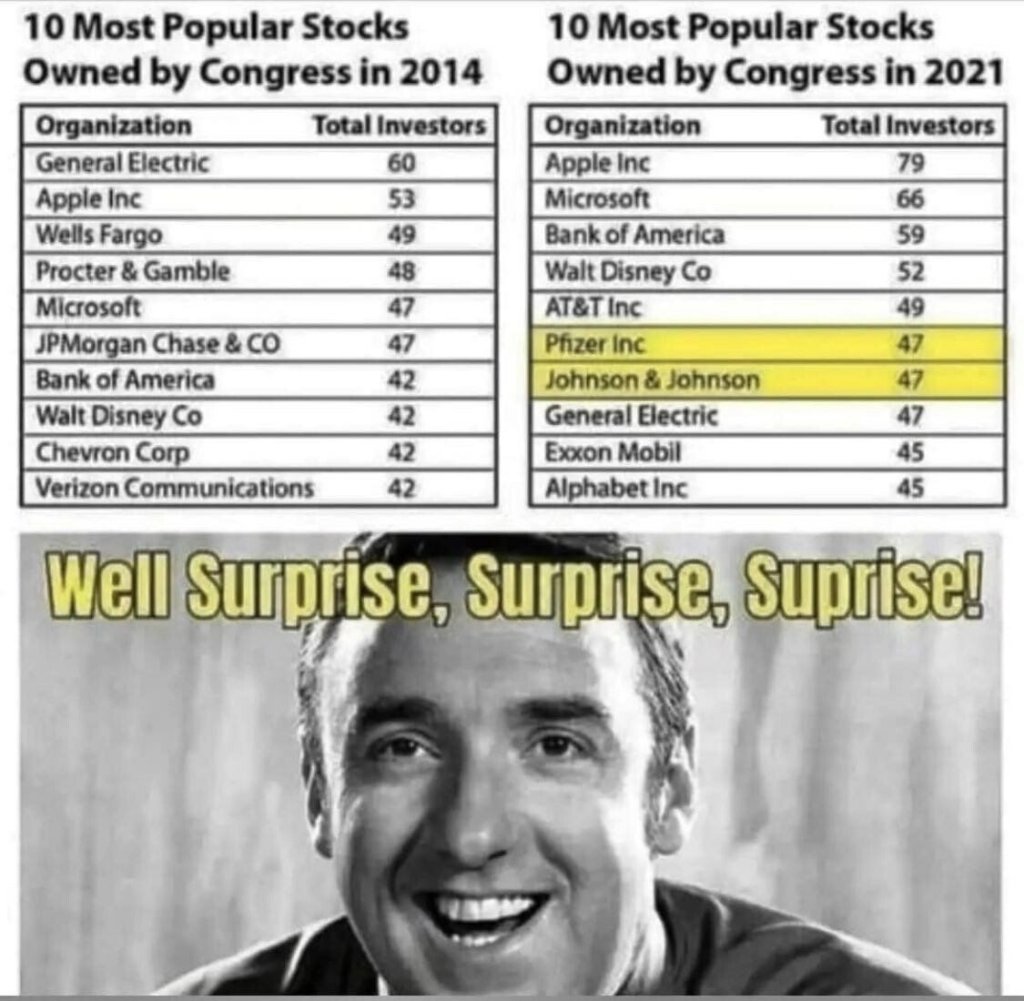

Like many others in Congress, Pelosi and her husband, Paul Pelosi, a San Francisco real estate investment mogul, have poured tons of money into the stock market and profited millions off of shares largely staked in Big Tech stocks such as Alphabet, Google’s parent company. According to disclosure forms collected in the House, Pelosi has reported holding stocks in Microsoft, Roblox, Netflix, and recently sold Facebook and Apple shares.

Pelosi isn’t the only member of Congress who makes money off of trading on some of the same companies that are regularly called to testify in front of her chamber’s committees. A recent report from Insider found that 49 other legislators not only frequently involved themselves in stock trades but also failed to disclose their dealings in accordance with the STOCK Act in a timely manner or at all. The list is filled with Republicans and Democrats who, despite the law designed to curb any insider trading and conflicts of interest, “offer excuses including ignorance of the law, clerical errors, and mistakes by an accountant” to justify their lack of financial disclosures.

Keep reading

You must be logged in to post a comment.