Will Rogers on taxes…

In its ongoing attempt to investigate and gather information about private U.S. citizens, the Congressional 1/6 Committee is claiming virtually absolute powers that not even the FBI or other law enforcement agencies enjoy. Indeed, lawyers for the committee have been explicitly arguing that nothing proscribes or limits their authority to obtain data regarding whichever citizens they target and, even more radically, that the checks imposed on the FBI (such as the requirement to obtain judicial authorization for secret subpoenas) do not apply to the committee.

As we have previously reported and as civil liberties groups have warned, there are serious constitutional doubts about the existence of the committee itself. Under the Constitution and McCarthy-era Supreme Court cases interpreting it, the power to investigate crimes lies with the executive branch, supervised by the judiciary, and not with Congress. Congress does have the power to conduct investigations, but that power is limited to two narrow categories: 1) when doing so is designed to assist in its law-making duties (e.g., directing executives of oil companies to testify when considering new environmental laws) and 2) in order to exert oversight over the executive branch.

What Congress is barred from doing, as two McCarthy-era Supreme Court cases ruled, is exactly what the 1/6 committee is now doing: conducting a separate, parallel criminal investigation in order to uncover political crimes committed by private citizens. Such powers are dangerous precisely because Congress’s investigative powers are not subject to the same safeguards as the FBI and other law enforcement agencies. And just as was true of the 1950s House Un-American Activities Committee (HUAC) that prompted those Supreme Court rulings, the 1/6 committee is not confining its invasive investigative activities to executive branch officials or even citizens who engaged in violence or other illegality on January 6, but instead is investigating anyone and everyone who exercised their Constitutional rights to express views about and organize protests over their belief that the 2020 presidential election contained fraud. Indeed, the committee’s initial targets appear to be taken from the list of those who applied for protest permits in Washington: a perfectly legal, indeed constitutionally protected, act.

This abuse of power is not merely abstract. The Congressional 1/6 Committee has been secretly obtaining private information about American citizens en masse: telephone records, email logs, internet and browsing history, and banking transactions. And it has done so without any limitations or safeguards: no judicial oversight, no need for warrants, no legal limitations of any kind.

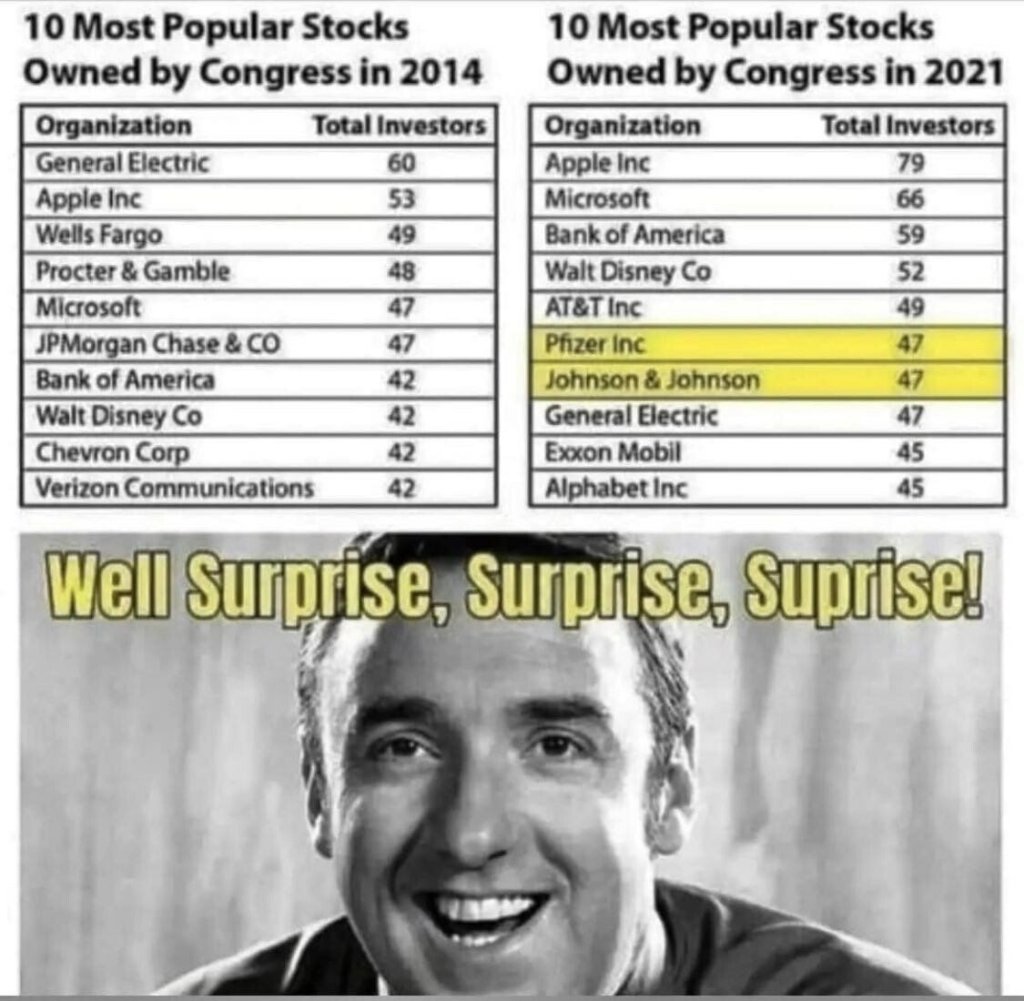

Members of Congress and their immediate families exchanged more than $630 million in stocks this year.

A report from The New York Times’ DealBook — based upon research conducted by Capitol Trades — revealed that asset purchases amounted to $267 million, while sales amounted to $364 million:

About 60 percent of these trades were in company stocks, with the rest split among funds, bonds and other assets. Republicans bought $100 million worth of stocks this year, versus $75 million for Democrats, according to the average of ranges that lawmakers provide in filings.

Politicians from the two major parties displayed distinct portfolio preferences:

Democrats are really into tech stocks, which accounted for some $35 million, or nearly half of all purchases by the group (versus only 14 percent for Republicans). Microsoft was the most popular big-ticket buy: The husband of Representative Suzan DelBene of Washington is a former Microsoft executive who sold between $5 million and $25 million in the company’s stock in October, which she reported past the 45-day deadline, prompting criticism. House Speaker Nancy Pelosi’s husband is a real estate and venture capital investor who is active on the stock market, making a pair of million-dollar purchases of Microsoft stock during the year, among other trades.

Republicans are more about energy, buying $32 million worth of stock in companies in the sector during the year, about a third of all purchases (versus a mere 1 percent for Democrats). Representative Mark Green of Tennessee was associated with many of the biggest energy trades, spreading six-figure purchases across a range of firms.

According to The New York Times, members of Congress also traded $26 million in stock options and $300,000 in cryptocurrencies.

Speaker of the House Nancy Pelosi doesn’t want Congress banned from trading stocks because she profits big from her and her husband’s investments on a regular basis.

In a press conference on Monday, the Democrat said that representatives and senators should do their best to comply with the reporting standards required by the Stop Trading on Congressional Knowledge Act, signed into law in 2012, but rejected the suggestion that legislators and their spouses should be barred from trading.

“We are a free market economy that should be able to participate in that,” Pelosi said.

Like many others in Congress, Pelosi and her husband, Paul Pelosi, a San Francisco real estate investment mogul, have poured tons of money into the stock market and profited millions off of shares largely staked in Big Tech stocks such as Alphabet, Google’s parent company. According to disclosure forms collected in the House, Pelosi has reported holding stocks in Microsoft, Roblox, Netflix, and recently sold Facebook and Apple shares.

Pelosi isn’t the only member of Congress who makes money off of trading on some of the same companies that are regularly called to testify in front of her chamber’s committees. A recent report from Insider found that 49 other legislators not only frequently involved themselves in stock trades but also failed to disclose their dealings in accordance with the STOCK Act in a timely manner or at all. The list is filled with Republicans and Democrats who, despite the law designed to curb any insider trading and conflicts of interest, “offer excuses including ignorance of the law, clerical errors, and mistakes by an accountant” to justify their lack of financial disclosures.

Fifteen lawmakers serving on House and Senate committees that shape U.S. military policy are profiting from investments in prominent defense contractors benefited by the very policies they influence, according to federal financial records analyzed by Business Insider this week.

Insider examined nearly 9,000 financial reports for every sitting member of Congress, as well as their top staffers, as part of a broader effort dubbed the Conflicted Congress project, which aims to identify possible conflicts of interest among lawmakers in Congress. Both Democrats and Republicans serving on the Armed Services committees have combined defense industry investments nearing $1 million as of 2020, and they’re continuing to invest and cash in.

Among the contractors that appeared in the committee members’ financial disclosures were Lockheed Martin Corp., Boeing Co., Raytheon Technologies Corp., Honeywell, and General Electric. Each company is known for spending millions to lobby the federal government in an effort to win lucrative government contracts and shape public policy.

An investigator with the House of Representatives’ select committee investigating the Jan. 6 U.S. Capitol breach has admitted privately that the panel erroneously asserted a former New York City police commissioner was in Washington on Jan. 5, but the assertion remains on the committee’s website.

Bernard Kerik, the former commissioner, was subpoenaed earlier this month by the panel, formally known as the Select Committee to Investigate the January 6th Attack on the United States Capitol.

In announcing the subpoena, the panel, which is primarily comprised of Democrats after House Speaker Nancy Pelosi (D-Calif.) rejected several Republican picks, claimed that Kerik “reportedly participated” in a Jan. 5 meeting at the Willard Hotel in Washington.

In the subpoena itself (pdf), the panel cited three sources for its claim: the book “Peril,” penned by two Washington Post reporters, and two articles published by the paper.

The problem? None of the sources actually say Kerik was at the reported meeting.

You must be logged in to post a comment.